Basis of Allotment - IPO Listing Process

The Basis of Allotment is an essential disclosure published during the IPO process, detailing how shares are allocated among different investor categories such as QIBs, NIIs, and Retail Investors. Prepared by the Registrar to the Issue (RTA) in consultation with the stock exchange and Book Running Lead Manager (BRLM), it ensures fairness and transparency in case of over or under-subscription. The document includes subscription figures, anchor investor allocations, and post-technical rejection allotments. Whether it’s a fixed price or book-built IPO—Mainboard or SME—the allotment method is determined as per SEBI’s ICDR regulations, ensuring compliance and investor trust.

Q1 What is the basis of allotment?

The RTA (Registrar to IPO) publishes a document relating to the basis of allotment in an IPO. It is published on the Registrar’s website and in leading newspapers. This document contains the basis by which shares have been allocated to the Investor categories (QIB, HNI, and Retail Individual Investors) as per SEBI guidelines. IPO Allotment is made with the consultation of BRLM, Exchange, and RTA. Basis of Allotment is important for fair distribution of shares in case of oversubscription of shares in IPO.

Q2 How basis of allotment is directly related to subscription levels?

Basis of allotment is a process to be followed when there is an oversubscription of shares in IPO. The basis of allotment is used to ensure an equitable distribution of shares amongst the investor categories based on guidelines of the Regulator (SEBI). The shares are allotted on proportionate basis (Pro- rata) or through lottery system for retail investors. The shares are credited to the de-mat account of the successful allottees while the application money is refunded to the non-allottees.

Q3 What information is included in the Basis of Allotment Document?

- Highlights the Risk to investors

- Proposed IPO Listing Date

- Information on Anchor Investor bidding, its Anchor Investor allocation price, number of applications received from Anchor investors, number of shares allotted under the Anchor investor portion.

- Subscription Details

- Details of Applications received

- Allotment details of Retail Individual Investors after technical rejections

- Allotment details of NII after technical rejections

- Allotment details of QIB Investors after technical rejections

- Allotment details of Anchor Investors after technical rejections

- Allocation details of Market Maker

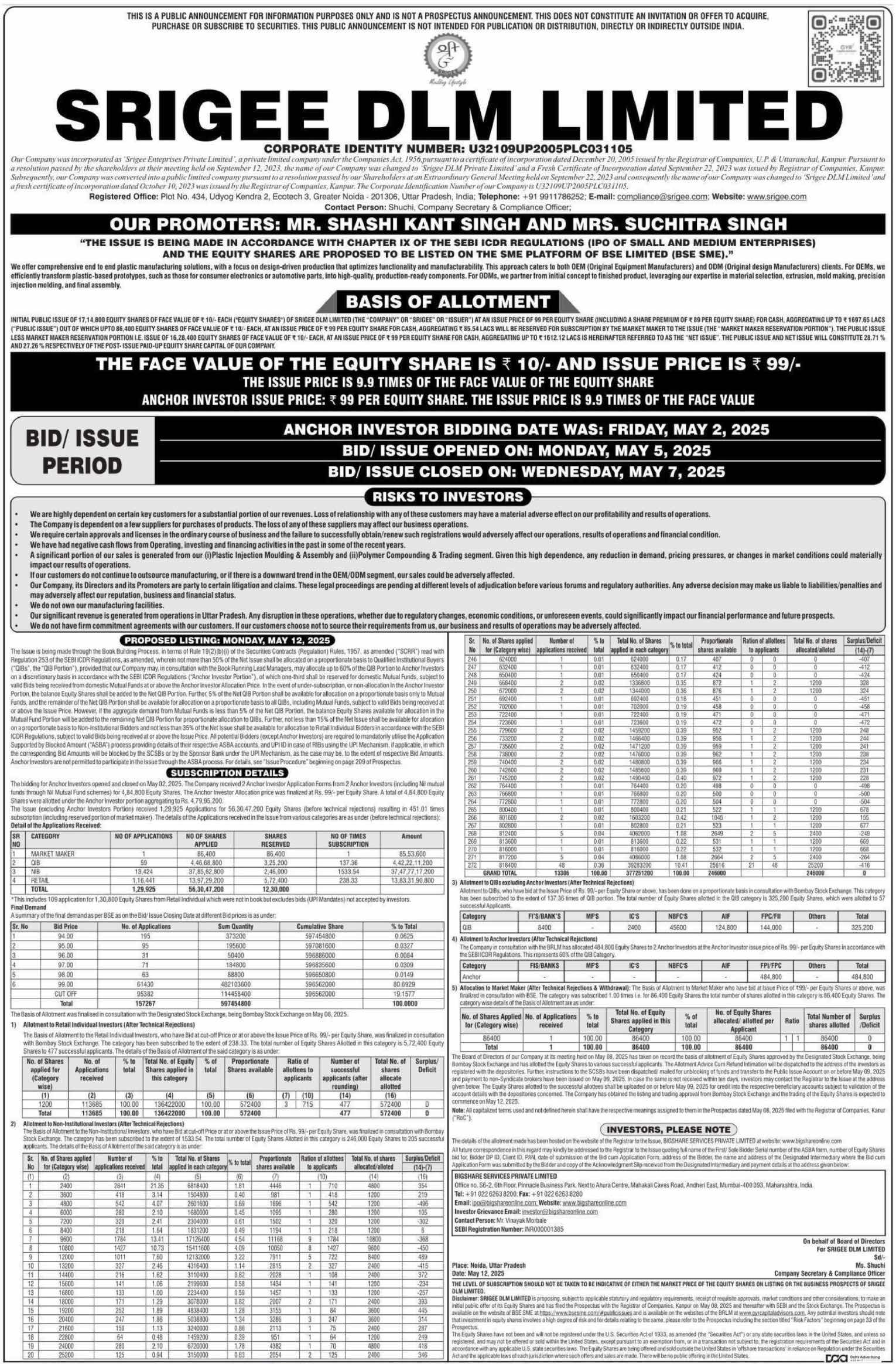

Screenshot of BOA document (Srigee)

IPO Allotment – Handling Different Subscription Scenarios

In Case of Oversubscription (Over Subscribed):

When the number of shares requested exceeds the number of shares offered in the issue, the allotment is conducted on a proportionate basis. This means each investor receives a share of the shares they applied for, based on the overall demand.

In Case of Full Subscription (Fully Subscribed):

When the total number of shares applied for equals the number of shares offered, the allotment is completed in full based on the number of shares requested by each investor.

In Case of Undersubscription (Under Subscribed):

In case, the IPO subscription is less than 90% of the Issue size, the Issuer has to refund the application money to the investors as regulated by SEBI.

If the total subscription is 90% or more, but still less than 100%, the allotment is made on a proportionate basis. In such case of undersubscription, retail or NII can be reallocated to other categories (spillover). It is to be noted that the QIB undersubscription cannot be filled from other categories.

Q4 What are the basis of allotment rules in IPO? (as per SEBI ICDR Regulations)

MainBoard IPO

In case of Book Built IPO Type

- Minimum 35% of shares must be reserved for retail Investors.

- Minimum 15% of shares must be reserved for Non-Institutional Investors.

- Maximum 50% of shares can be allocated to qualified Institutional Buyers.

QIB Route of Mainboard IPO

- Maximum 10% of shares can be allocated to Retail Investors

- Maximum 15% of shares can be allocated to Non Institutional Investors (NII)

- Minimum 75% of shares must be allocated to QIBs

In case of Mainboard Fixed Price IPO Type

Retail Individual Investors (RIIs): Not less than 50% shall be allocated to RII

Others (non-retail individuals, corporates, institutions): Remaining 50% to others

In Case of SME IPO, Book Building Method

a. Retail Individual Investors (RIIs): Not less than 35% of the net offer shall be allocated to RIIs.

b. Non-Institutional Investors (NIIs): Not less than 15% of the net offer shall be allocated to NIIs.

c. Qualified Institutional Buyers (QIBs): Not more than 50% of the net offer shall be allocated to QIBs. Within this 50%, 5% shall be allocated to mutual funds.

Other points to be noted are

- If there is any unsubscribed portion in categories (a) [RIIs] or (b) [NIIs], it may be reallocated to applicants in any other category.

- In addition to the 5% reserved within the QIB category, mutual funds are also eligible for allocation from the remaining QIB portion.

In Case of SME IPO , Fixed Price Method

Retail Individual Investors (RIIs): Not Less than 50% of the shares shall be allocated to RII

Others (non-retail individuals, corporates, institutions): Remaining 50%

Other Points to be noted are

- Unsubscribed shares in either category can be reallocated to the other.

- Under-subscription, if any, except the QIB Category, would be allowed to be met with spill-over from any other category at the discretion of our Company in consultation with the BRLM and the Designated Stock Exchange.

- The Equity Shares, on Allotment, shall be traded only in the dematerialized segment of the Stock Exchanges.

Who decides the Basis of Allotment?

The Basis of allotment is decided by Exchange in coordination with RTA and BRLM. stock exchange, along with the lead manager(s) and registrars to the Issue. BOA (basis of Allotment) ensures that the allotment is finalised properly and fairly.

Basis of Allotment explained with Example

Example 1- Swasth Foodtech IPO is a Fixed Price IPO as per Regulation 229(2) of SEBI ICDR Regulations and Regulation 253 where 50% of the Net Issue is available for Retail Individual Investors and balance 50% is available to other than Retail Individual Investors.

- Issue Size: 15,87,600 equity shares

- IPO price band of Rs 94/- per equity share (including a securities premium of Rs 84/- per equity share)

- Issue Size - Rs 1,492.34 lakhs

- 80,400 equity shares aggregating to Rs 75.58 lakhs will be reserved for subscription by market maker ("market maker reservation portion being 5% of Issue Size)

- Net issue would be 15,07,200 equity shares (Total IPO size less Market Maker Portion)

- The Issue and the Net issue will constitute 27.10% and 25.73%, respectively, of the post-issue paid-up equity share capital of the company

- The Issue received 8,371 applications for 1,14,14,400 equity shares (before technical rejections), resulting in subscription of 7.19x. (including reserved portion of market maker)

Before technical rejection

|

Category |

Number of applications Received |

Number of equity shares Bid for (lot size of 1200 shares per lot for retail and 2400 shares per lot for other than Retail) |

Number of equity shares reserved as per Prospectus |

Number of times subscribed (no. of equity shares bids for/No. of equity shares reserved) |

|

Retail Individual Investors |

7,833 |

94,02,000 |

7,53,600 |

12.48 |

|

Other than Retail Individual Investors |

537 |

19,32,000 |

7,53,600 |

2.56 |

|

Market Maker |

1 |

80,400 |

80,400 |

1.00 |

|

Total |

8,371 |

1,14,14,400 |

15,87,600 |

7.19 |

Details of Valid Applications- After rejection of invalid bids shares allotted to the valid applicants on a proportionate basis.

|

|

|

|

Number of shares reserved |

Rejections |

Valid after rejection |

Allotment |

|||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Category |

Number of applications Received |

Number of equity shares Bid for |

No. of application |

Equity shares |

No. of application |

Equity shares |

No. of application |

Equity shares |

Allottees |

Equity Shares |

|

|

Retail Individual Investors |

7,833 |

94,02,000 |

7,53,600 |

12.48 |

125 |

1,52,400 |

7,708 |

92,49,600 |

1,042 |

12,50,400 |

|

|

Other than Retail Individual Investors |

537 |

19,32,000 |

7,53,600 |

2.56 |

10 |

26,400 |

527 |

19,05,600 |

188 |

2,56,800 |

|

|

Market Maker |

1 |

80,400 |

80,400 |

1.00 |

- |

- |

1 |

80,400 |

1 |

80,400 |

|

|

Total |

8,371 |

1,14,14,400 |

15,87,600 |

7.19 |

|

|

|

|

|

15,87,600 |

|

Example 2- Srigee DLM IPO is a Book Building IPO and as per regulation 253 of SEBI ICDR Regulation, 50% of the Net Issue shall be allocated to QIBs (Qualified Institutional Buyers), 15% to NII (Non Institutional Investors) and balance 35% shall be allocated to Retail Individual Investors.

- Issue Size - 17,14,800 equity shares

- IPO Price band -Issue price is Rs. 99 per equity share (Including Rs 89 security premium)

- Market maker Reservation- 86,400 equity shares

- Net Issue :- 16,28,400

- Lot Size :- 2000

IPO Subscription Details (before technical rejection)

|

Category |

Number of applications Received |

Number of equity shares Bid for |

Number of equity shares reserved as per the Prospectus |

Number of times subscribed |

|

Retail Individual Investors |

1,16,441 |

13,97,29,200 |

5,72,400 |

238.33 |

|

Other than Retail Individual Investors |

13,424 |

37,85,62,800 |

2,46,000 |

1533.54 |

|

QIB |

59 |

4,46,68,800 |

3,25,200 |

137.36 |

|

Market Maker |

1 |

86,400 |

86,400 |

1 |

|

Total |

|

|

12,30,000 |

|

Allotment Details of valid Bids

|

Number of shares applied (category-wise) |

Number of applications Received |

|

Shares available as per prospectus |

Ratio |

Ratio |

Number of successful applicants |

Total number of shares allotted |

|

1200 |

113685 |

13,64,22,000 |

572400 |

3 |

715 |

477 |

572400 |

|

Total |

|

|

|

|

|

|

|

Retail Investors

|

Number of shares applied (category-wise) |

Number of applications Received |

Number of equity shares Bid for |

Shares available as per the prospectus |

Number of successful applicants |

Total number of shares allotted |

|---|---|---|---|---|---|

|

818400 |

133006 |

37,72,51,200 |

2,46,000 |

205 |

2,46,000 |

|

Total |

|

|

|

|

|

Allotment to Non-Institutional Investors

Allotment to QIBs excluding Anchor Investors

|

Category |

FI’s/Bank |

MFS |

IC’s |

NBFC’s |

AIF |

FPC/FII |

Others |

Total |

|---|---|---|---|---|---|---|---|---|

|

QIB |

8400 |

- |

2400 |

45600 |

124800 |

144000 |

- |

325200 |

|

|

|

|

|

|

|

|

|

|

Allotment to QIBs excluding Anchor Investors

|

Category |

FI’s/Bank |

MFS |

IC’s |

NBFC’s |

AIF |

FPC/FII |

Others |

Total |

|---|---|---|---|---|---|---|---|---|

|

Anchor |

8400 |

- |

- |

- |

- |

484800 |

- |

484800 |

|

|

|

|

|

|

|

|

|

|

Allotment to Market Maker

|

Number of shares applied (category-wise) |

Number of applications Received |

Number of equity shares Bid for |

Shares available as per prospectus |

Ratio |

Ratio |

Number of successful applicants |

Total number of shares allotted |

Number of shares applied (category-wise) |

|---|---|---|---|---|---|---|---|---|

|

86400 |

1 |

86400 |

86400 |

1 |

1 |

86400 |

- |

86400 |

|

|

|

|

|

|

|

|

|

|

What does basis of allotment mean?

Basis of allotment means the mode through which RTA, exchange and BRLM allot shares as per the guidelines of ICDR and allot shares to the applicant for each category.

What is the basis of the allotment date?

The allotment date is the date on which the document containing the basis of allotment is issued. The basis of allotment is finalized by RTA in consultation with the exchange and BRLM.

What is the IPO allotment formula?

IPO Allotment depend on the levels of IPO subscription. Allotment is made on a proportionate basis in case of oversubscription. Allotment is made to all the valid applicants in case of full subscription.

How to increase the chances of IPO allotment?

Although there is no such tip for guaranteed allotment in case of IPO but there are few things one can increase the chances of allotment

- Use of multiple Demat accounts of friends and relatives.

- Select cut off price

- Avoid last minute application to prevent technical rejections

How to check the allotment status?

The allotment status can be checked through NSE website, RTA website and few other websites are also available through that one can check the status of allotment.

What is proportionate basis of allotment?

Proportionate basis of allotment is the mode of allotment through which allotment made to the investors in case of over subscription of IPO. It means an investor applied for 2000 shares but 1000 shares is only available then those who made the application of 2000 will have the 1000 shares in the ration of 1: 2.

Who finalizes the basis of allotment?

Basis of allotment is finalized by the RTA, in consultation with RTA and BRLM , all should ensure that basis of allotment is finalized in a fair and proper manner as per the guidelines of ICDR.

0 Comments