IPO Report in May 2025 for SME IPO and Mainboard IPO

Understanding the IPO landscape is crucial for investors looking to make informed decisions, and having access to up-to-date data on upcoming IPOs is key. This data provides valuable insights into the companies which are filing their Draft Red Herring Prospectus (DRHP), the sectors they represent, and the merchant bankers backing them. By analyzing this information, investors can identify emerging opportunities, assess market trends, and make more strategic choices. With the right data, investors can stay ahead of the curve, ensuring they don’t miss out on best IPOs and can optimize their investment strategies for better returns.

May 2025 IPO Activity: Exciting Opportunities for Investors

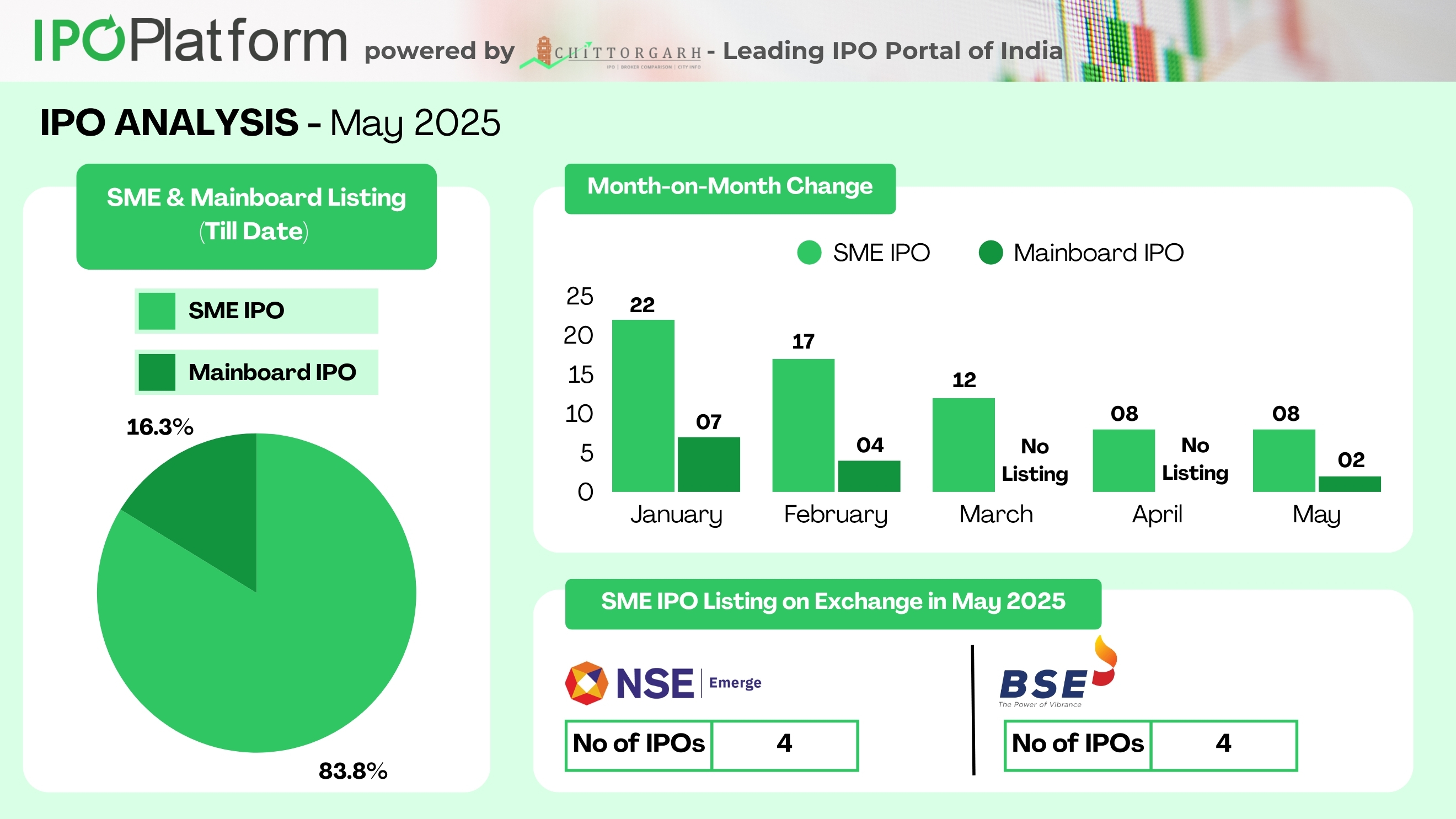

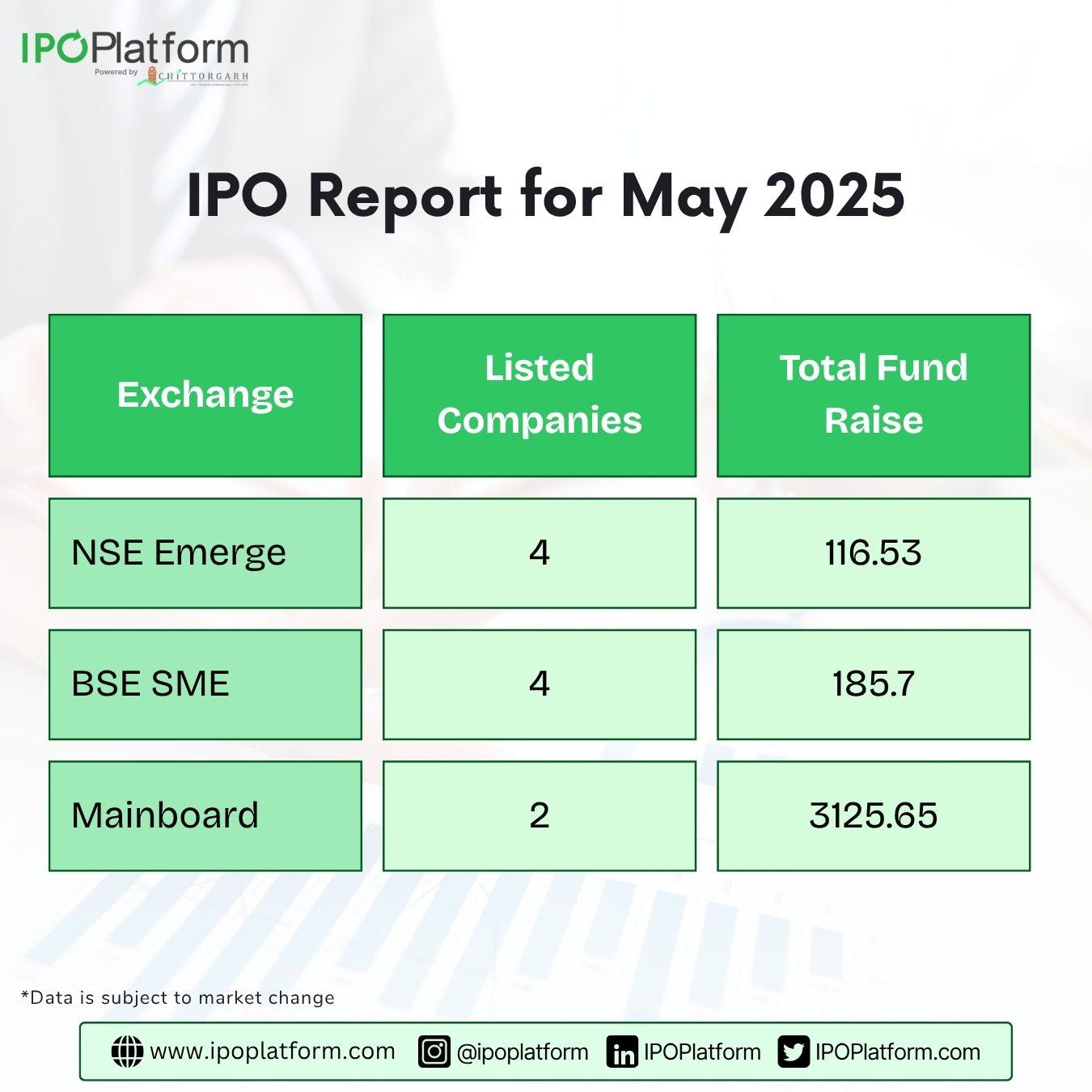

In the month of May 2025, 13 companies have filed Draft Red Herring Prospectus (DRHP). The filings include 12 companies filed DRHP with BSE SME exchange and 1 with NSE Emerge of the SME platform of India. Additionally, 8 SME IPO were listed in the month of May 2025.

7 companies have filed DRHPS on Main board platform in the month of May 2025. And 2 Companies got listed their IPO on Mainboard in May 2025.

This data offers investors a valuable look at upcoming IPOs, helping them spot opportunities based on sectors, cities, and merchant bankers. Platforms like ipoplatform.com provide real-time updates, ensuring investors stay informed and ready to capitalize on the next big opportunity. With detailed IPO listings, sector insights, and expert advice, IPO Advisors make it easier for investors to make confident, data-driven decisions.

Key Highlights of the Month May (IPO 2025)

- 13 Companies have filed DRHP with Recognized Stock Exchanges such as;

- 12 Companies have filed DRHPs with BSE SME exchange and,

- 1 Companies have filed DRHPs with NSE Emerge.

- 7 Companies have filed DRHP (Mainboard) with SEBI.

- 8 SME IPO got listed in the month of May through NSE Emerge and BSE SME.

- 2 Mainboard IPO got listed their securities on NSE and BSE stock Exchanges.

- IPOs to open in 1st week of June

List of Upcoming SME IPOs whose DRHPs are filed with BSE SME Exchange;

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|---|---|---|---|---|---|

|

|

Revenue |

PAT (Profit after Tax) |

|

|

|

|

Sunsky Logistics Limited |

22.04 |

2.59 |

Ahemdabad |

Nirbhay Capital Services Private Limited |

Logistics |

|

Workmate Core2Cloud Solutions Limited |

95.42 |

14.18 |

Kolkata |

Information technology |

|

|

Neptune Logitech Limited |

257.25 |

9.16 |

Kachchh |

Galactico Corporate Services Limited |

Logistics |

|

AJC Jewel Manufactures Limited |

233.4 |

2.47 |

Ernakulam |

Smart Horizon Capital Advisors |

Jewelry |

|

Systematic Industries Limited |

386.25

|

18.12

|

Mumbai |

Hem Securities Limited |

Steel – Iron |

|

Liotech Industries Limited |

40.68 |

4.16 |

Rajkot |

Furniture |

|

|

Vyara Tiles Limited

|

112.77 |

9.48 |

Surat |

Share India Capital Services Private Limited |

Ceramic And Stone - Marble, Tiles And Granite

|

|

Twinkle Papers Limited

|

76.67 |

3.92 |

Ludhiana |

Fast Track Finsec Private Limited |

Packaging and Disposables |

|

Arc Distributors (I) Limited

|

32.21 |

5.84 |

Mumbai |

Cumulative Capital Private Limited |

Retail |

|

Purple Wave Infocom Limited

|

119.23 |

8.76 |

New Delhi |

Smart Horizon Capital Advisors Private Limited |

Advertising & Media |

|

LT Elevator Limited

|

42.23 |

3.95 |

Kolkata |

Electric Equipments |

|

|

Dhillon Freight Carrier Limited

|

26.13 |

1.35 |

Kolkata |

Finshore Management Services Limited |

Logistics |

List of Upcoming SME IPOs whose DRHPs are filed with NSE Emerge;

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|---|---|---|---|---|---|

|

|

Revenue |

PAT (Profit after Tax) |

|

|

|

|

Munish Forge Limited

|

170.77 |

14.04 |

Ludhiana |

Gretex Corporate Services Limited |

Automobile - Forging And Casting

|

List of Upcoming Mainboard IPOs whose DRHPs are filed with SEBI;

|

Name |

Key Financial Indicators (in Rs. Crores) |

City |

Merchant Banker |

Sector |

|

|---|---|---|---|---|---|

|

|

Revenue |

PAT(Profit after tax) |

|

|

|

|

Bharat Coking Coal Limited |

13,998.40 |

1,240.10 |

Dhanbad |

IDBI Capital Markets & Securities Limited ICICI Securities Limited |

Minerals |

|

Fusion Cx Limited |

1,234.00 |

62.90 |

Kolkata |

Nuvama Wealth Management Limited IIFL Capital Services Limited Motilal Oswal Investment Advisors Limited |

Information Technology |

|

Central Mine Planning & Design Institute Limited |

2,102.70 |

666.90 |

Ranchi |

IDBI Capital Markets & Securities Limited SBI Capital Markets Limited |

Minerals |

|

Kanodia Cement Limited |

959.33 |

130.93 |

Bulandshahr |

Oneview Corporate Advisors Private Limited Anand Rathi Securities Limited IIFL Securities Limited |

Cement |

|

KSH International Limited |

1,893.87 |

66 |

Pune |

ICICI securities Limited Nuvama Wealth Management Limited |

Cables and Wires |

|

Ravi Infrabuild Projects Limited |

1370 |

109.07 |

Udaipur |

Axis Capital Limited |

Infrastructure |

|

Mouri Tech Limited |

1,752.39 |

180.47 |

Hyderabad |

ICICI Securities Limited JM Financial Limited Nuvama Wealth Management Limited |

Information technology – Data Solutions |

Details of all Listed Companies in the month of May 2025:

SME IPOs to open in first week of June 2025:

|

Name |

Exchange |

IPO size (in crores) |

IPO Dates |

Price Band |

Merchant Banker |

Sector |

|---|---|---|---|---|---|---|

|

Ganga Bath Fittings Limited |

NSE Emerge |

32.65 |

4th June- 6th June |

49 |

Jawa Capital Services Private Limited |

Ceramic and Stone |

What is the role of IPO Advisors in listing of an IPO?

IPO Advisors and IPO Consultants play a crucial role in guiding companies through the complex process of listing an Initial Public Offering (IPO). Their primary responsibility is to ensure that the company meets the IPO eligibility requirements set by regulatory authorities and stock exchanges such as BSE SME and NSE Emerge.

We, at ipoplatform.com guide companies through the listing process, helping them meet all necessary requirements and connecting them with the best Merchant Bankers to maximize their fundraising potential. With expert advisory, valuation strategies, and investor outreach, IPO Advisors help companies achieve a successful public listing and unlock growth opportunities in the capital markets.

These professionals work closely with Merchant Bankers to structure the IPO, prepare financial disclosures, and ensure compliance with regulatory norms. They assist in drafting the Draft Red Herring Prospectus (DRHP), coordinating with regulatory bodies like SEBI, and facilitating due diligence.

Conclusion: Unlocking Opportunities with IPO 2025

The IPO market in May 2025 has started with strong momentum, with 20 companies filing their DRHPs across BSE SME, NSE Emerge, and the Mainboard. With 6 SME IPOs successfully listed in the month of May 2025 and several upcoming IPOs in June 2025, investors have numerous opportunities to explore.

For companies looking to go public, IPO Advisors play a crucial role in streamlining the IPO listing process. From compliance with regulatory requirements to selecting the right Merchant Bankers, these experts ensure a smooth transition into the capital markets. Platforms like ipoplatform.com provide real-time updates, expert insights, and the necessary guidance to help companies and investors make informed decisions.

As we move further into SME IPO 2025, staying updated on upcoming IPOs and analyzing key financials can help investors capitalize on high-growth opportunities. With strategic planning and expert guidance, both businesses and investors can unlock the full potential of the IPO market in 2025.

0 Comments