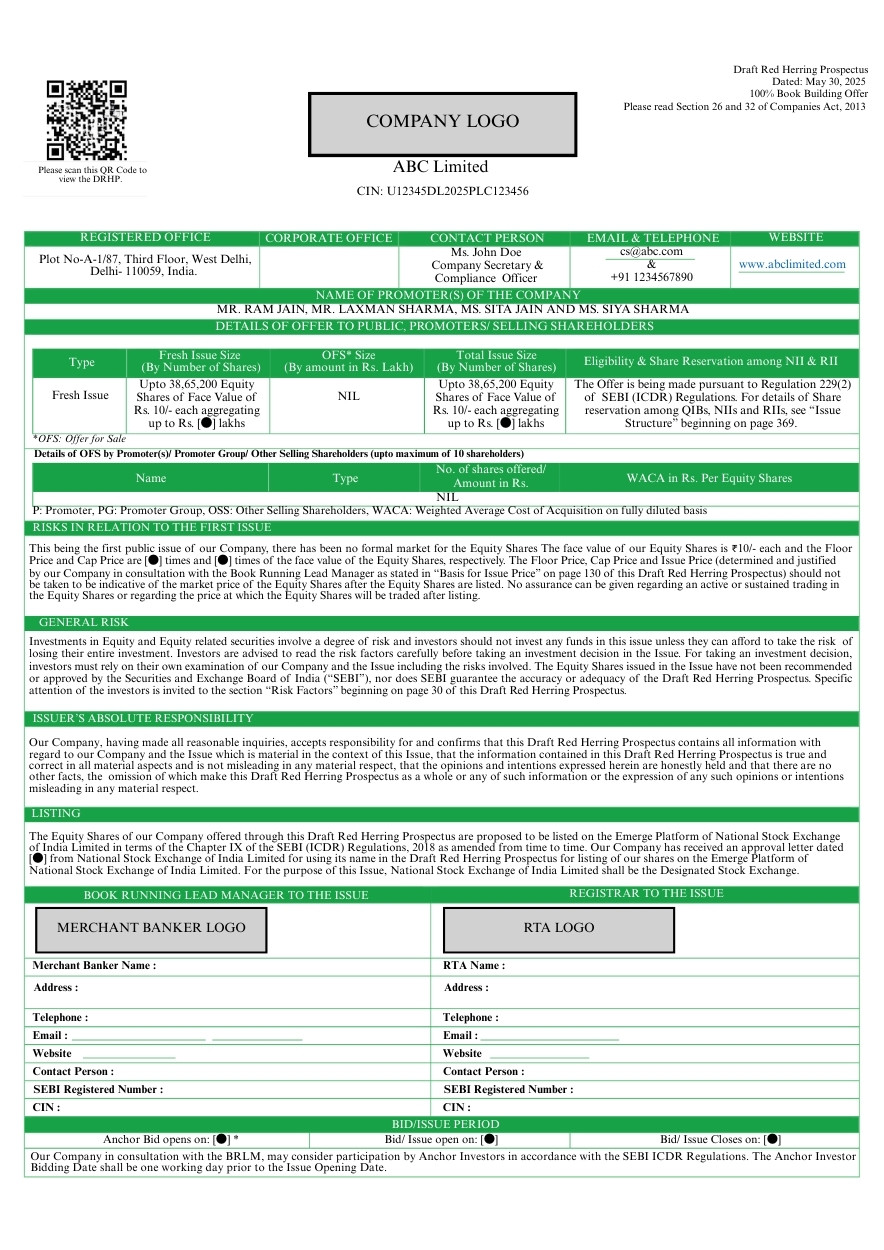

The cover page of the Draft Red Herring Prospectus (DRHP) serves as a formal gateway to the public offering, capturing key disclosures that define the issuer’s identity, offer structure, and compliance framework. Beyond fulfilling SEBI’s regulatory requirements, it sets the tone for transparency, guiding investors with essential highlights such as risk factors, issue type, and lead intermediaries involved. This initial presentation reflects the company’s preparedness and commitment to responsible capital raising in the SME IPO ecosystem.

|

Section |

Details |

|---|---|

|

1 Cover Page: |

|

|

Document Type |

Draft Red Herring Prospectus |

|

Date of Draft Offer Document |

Date of Draft Offer document |

|

Type of Issuance |

“Book built” or “Fixed price” |

|

Issuer Company Details |

- Name - logo - Incorporation date & place - CIN - Registered & corporate office address - Contact details, website & email - Name of the Company Secretary/Compliance Officer |

|

Promoter(s) Name |

- Names of the promoters |

|

Offer Details |

- IPO Type - Fresh Issue size (By number of shares) - Offer for Sale (By amount) - Total Issue size (By number of shares) - Eligibility and Share reservation among NII and RII - Details of Offer for sale by Promoter, promoter group/other selling shareholders (up to maximum of 10 shareholders) |

|

Risks in relation to the First Issue (Shall be incorporated in the Box format) |

- It is a clause that mentions there has been no prior market for Equity shares and no assurance can be given regarding active trading or price stability after listing. |

|

General Risk (Shall be incorporated in the Box format) |

- It is a clause that mentions about the risk involved in equity investments and advises to read the risk factors carefully that are stated in DRHP. |

|

Issuer’s Absolute Responsibility (Shall be incorporated in the Box format) |

- It is a clause that mentions about Issuer’s responsibility for truth and accuracy of all information and statements that are to be provided in offer document |

|

Stock Exchanges for Listing |

- Names of stock exchanges where the securities are listed and details of in-principle approval |

|

Book Running Lead Manager(s) to the Issue |

- Names - Logo - Addresses -Phone numbers, websites & email - SEBI registration Number - CIN |

|

Registrar to the Issue |

- Names - Logo - Addresses -Phone numbers, websites & email - SEBI registration Number - CIN |

|

Bid/Issue Period |

- Anchor bid period (if any) - Bid/Issue open (IPO open date) - Bid/Issue closes (IPO close date) |

|

Credit Rating (If applicable) |

- Provide the credit rating |

|

IPO Grading (If any) |

- Provide IPO grading |

|

2 Second Cover page of DRHP includes below information in addition to above information |

|

|

The Issue |

- Total number of equity shares to be Issued - Face value of equity shares - Number of shares reserved for Market maker - Note that Issue price is not required to be mentioned in DRHP. |

|

The face value of the equity shares is Rs. [●] each and the floor price and cap price are [●] times and [●] times of the face value of the equity shares, respectively. |

- To be mentioned that price band and minimum bid lot to be decided in consultation with Merchant bankers in India. - Advertisement regulations are applicable as per the amendments in 2025 in SEBI ICDR regulations, 2018. - It is a clause that states the IPO type and defines the allocation of equity shares in IPO to various investor categories which are Anchor, QIBs, Retail in accordance with SEBI ICDR Regulations, 2018. |

DRHP is a preliminary document filed by a company planning to launch an IPO. It provides important details about the company’s business, financials, and risks before the IPO is approved.

It takes a minimum 3 months for an IPO to open after filing of DRHP. The relevant stock exchanges take time to examine and approve the DRHP.

DRHP is a preliminary document whereas RHP is a final version which contains all disclosures and comments as addressed at the time of review of DRHP.

In a fixed price issue, the price is pre-decided, while in a book-built issue, the final price is determined through investor bidding.

RHP is the final IPO document filed with SEBI and the Registrar of Companies (ROC) before IPO opens.

UDRHP is a revised version of the Draft Red Herring Prospectus (DRHP) that includes all changes that are required by the stock exchange on examination of DRHP.

They ensure that all disclosures and changed suggested by the stock exchange are duly incorporated and provide investors with accurate and updated information regarding SME IPO.

RHP is typically filed 3-5 days before the IPO opens.

0 Comments