For companies planning to list on platforms like BSE SME or NSE SME, this section is vital to understand its compliance with IPO eligibility criteria as per SEBI guidelines for IPO. With the help of IPO advisors, businesses ensure that the financial disclosures comply with all requirements of the IPO process, making the offer more transparent and investor-friendly.

Additionally, this section is mandatory as per SEBI (Securities and Exchange Board of India) guidelines to ensure transparency and protect investor interests. It also shows how the IPO will impact the company’s financial situation, including how the raised funds will be used and how they might improve the company’s future position.

This is a report from an independent auditor confirming that the financial information is correct and fairly presented.

It discloses on dividend payouts in the past years and dividend policy that it would follow in future.

IPO advisors or SME IPO Consultants play a crucial role in guiding the company through the IPO process. They assist with structuring the offering, preparing necessary documentation, IPO pricing with fair valuations, ensuring regulatory compliance, due diligence activity, and helping market the IPO to potential investors. Their expertise ensures a smooth and successful public listing.

IPO platform in India provides information on upcoming IPOs on NSE Emerge and BSE SME and list of merchant bankers and anchor investors. Role of IPO advisor is important in the success of the listings.

To execute an IPO in Mainboard it takes approximately from 8 to 12 months and SME IPO it takes approximately 4 to 6 months.

The post-issue paid-up capital should not exceed Rs 25 crores.

The company must have at least 3 full financial years of track record of business to list on NSE Emerge or BSE SME stock exchanges of India.

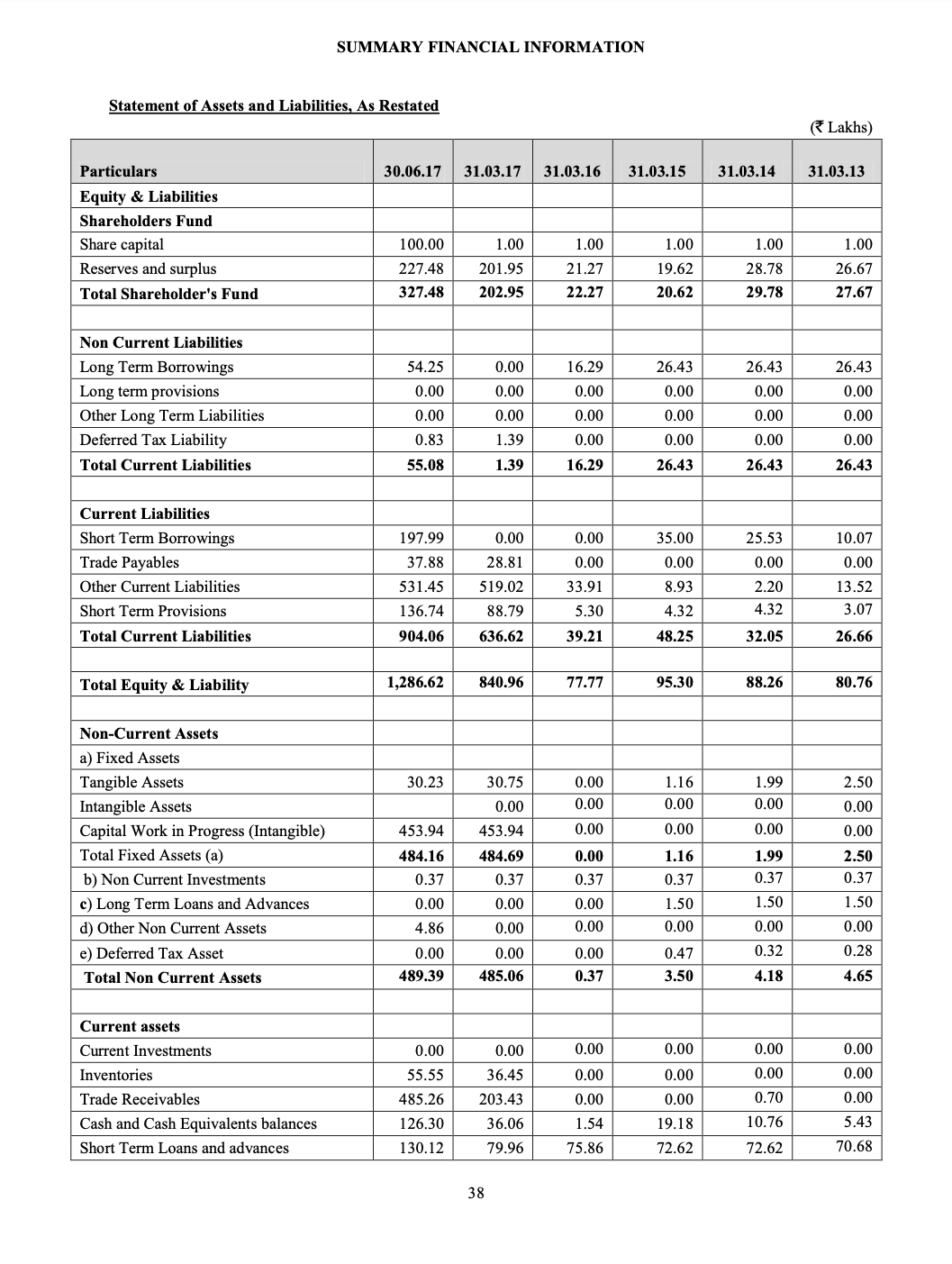

Net worth is the sum of paid up capital and reserves and surplus appearing in the balance sheet of a company. The eligibility criteria require the net worth to be at least Rs 3 crores for SME IPO for NSE Emerge. BSE SME listing requirement states that the net worth shall be Rs 1 crore for preceding two full financial years.

The company must have operating profits or EBITDA of at least Rs 1 crore for two out of the last three financial years. There is no threshold for turnover though.

As per BSE SME IPO eligibility and listing requirements debt should not exceed three times the equity. Hence, leverage ratio shall not be more than 3:1

0 Comments