Rajasthan Global Securities Pvt. Ltd. sets National Benchmark by Anchoring 100 SME IPOs

India’s Small and Medium Enterprises (SMEs) are at the heart of inclusive growth, employment generation, and grassroots entrepreneurship. While their economic role is vital, SMEs have historically struggled to access long-term, formal capital. The SME Exchange, launched to bridge this gap, initially lacked institutional support. Post-pandemic recovery reignited IPO activity, but anchor-level confidence remained elusive—until Rajasthan Global Securities Pvt. Ltd. (RGSPL) stepped in. As one of the earliest institutional investors to actively participate in SME IPOs through the book-building route, RGSPL played a game-changing role. With its strategic foresight and capital commitment, the firm didn’t just invest—it institutionalized trust, scaled up credibility, and inspired market-wide participation. This article celebrates RGSPL’s landmark 100th anchor investment and its lasting impact on India’s SME ecosystem.

Pioneering the Institutionalization of India’s SME Capital Market

India’s SMEs: Catalysts of Equitable Growth and Economic Resilience

India’s Small and Medium Enterprises (SMEs) are not merely a business classification—they are the cornerstone of the country’s economic transformation and social empowerment. Spread across diverse geographies and industry verticals, SMEs encapsulate the spirit of grassroots entrepreneurship, regional innovation, and decentralized development.

From fostering employment and advancing financial inclusion to fortifying supply chains and driving self-reliant industrialization, SMEs form the foundation of a resilient and inclusive economic framework. Their agility, adaptability, and proximity to underserved markets have made them pivotal in addressing local economic disparities and ensuring the formalization of India’s growth engine.

Yet, despite their systemic importance, SMEs have long faced structural barriers to accessing long-term capital, especially through formal equity channels. While the establishment of the SME Exchange platform was a significant policy milestone aimed at democratizing access to capital markets, the platform initially struggled to garner meaningful institutional interest. For much of its early years, the ecosystem remained underpenetrated and under-leveraged by large financial institutions.

The Pre-Pandemic Landscape: A Market in Search of Institutional Confidence

By the year 2020, more than a decade after the launch of the SME Exchange, the platform continued to be predominantly supported by retail and high-net-worth individual (HNI) investors, with institutional investors maintaining a cautious distance. Only 20 SME IPOs were floated that year, most of which were issued via the fixed-price route, reflecting limited risk appetite and subdued capital formation.

Merchant bankers refrained from filing SME IPOs through the book-building mechanism—a method recognized for its transparency and price discovery—largely due to the absence of Qualified Institutional Buyers (QIBs) willing to anchor such offerings. The regulatory provision mandating that up to 50% of the issue (net of market maker allocation) be reserved for QIBs, and that 60% of that portion be allocated to anchor investors—with lock-in requirements of one and three months—further discouraged institutional participation. These conditions, though well-intentioned, were seen as restrictive by investors who prioritized liquidity and agility.

In the absence of early-stage institutional validation, merchant bankers lacked confidence in the successful subscription of book-built IPOs, perpetuating a cycle of conservatism. The SME Exchange, while structurally sound, remained a largely retail-driven platform, with limited depth, scale, or institutional legitimacy.

Post-Pandemic Revival: Accelerated Listings, Renewed Optimism

The onset of economic recovery following the COVID-19 pandemic marked a significant inflection point in the SME IPO ecosystem. As investor sentiment rebounded and capital markets soared, 2021 witnessed a sharp uptick in SME listings, with 59 companies tapping public markets—a near threefold increase from the previous year. This surge was underpinned by heightened interest in emerging, scalable, and thematically distinct business models, particularly from retail and HNI segments.

Despite this momentum, however, a critical gap remained—the continued absence of institutional investors in book-built SME IPOs. While broader participation had improved, the lack of anchor-level capital and QIB validation continued to limit the scalability and credibility of offerings. The market’s structure demanded a pioneering player to step forward and fill the institutional void—to inspire confidence, standardize participation, and transform perception.

It was against this backdrop of change and opportunity that Rajasthan Global Securities Pvt. Ltd. (RGSPL) emerged as a visionary institutional catalyst in India’s SME capital markets. Rather than wait for the ecosystem to mature, RGSPL led from the front, becoming one of the earliest institutional investors to actively anchor SME IPOs through the book-building route.

Unlike others that remained hesitant, RGSPL recognized the long-term potential of India’s SME segment—not merely as a high-return opportunity, but as a national imperative. It entered the space with conviction, committing capital and credibility at a time when few were willing to do so. In doing so, RGSPL became a cornerstone of issue success, helping merchant bankers structure robust, scalable offerings that inspired broader market trust.

The firm’s contribution went beyond capital—it ushered in a new era of institutional participation, aligning market development with national goals of entrepreneurship, formalization, employment, and financial inclusion.

Rajasthan Global Securities: The Institutional Game-Changer

At this inflection point, Rajasthan Global Securities Pvt. Ltd. (RGSPL) stepped in with strategic conviction. A Delhi-based NBFC with a focused mandate on structured lending and capital markets, RGSPL became one of the earliest and most consistent anchor investors in SME IPOs filed through the book-building route.

Despite early uncertainty and thin institutional participation, RGSPL demonstrated visionary leadership by becoming an anchor investor — providing crucial confidence to merchant bankers, ensuring issue success, and ultimately redefining SME IPO market standards.

Its timely entry catalyzed a wider institutional shift. As other QIBs gradually followed, the SME market began attracting broader attention, entering a mature, scalable, and institutionally-supported phase — nearly 12 years after the platform’s inception.

This vision has culminated in a historic milestone—RGSPL has officially anchored its 100th SME IPO with the investment in Shri Hare-Krishna Sponge Iron Limited, a landmark that not only reinforces its leadership in the segment but also reflects the evolving maturity and credibility of India’s SME capital market.

RGSPL's participation was not just opportunistic—it aligned with a broader national vision. By supporting capital access for small enterprises, RGSPL strengthened the government’s mission of enhancing entrepreneurship, job creation, and financial inclusion. The firm’s role helped in mainstreaming the SME platform and elevating its status from a niche to a credible investment destination.

RGSPL’s success is driven by the strategic foresight of its Managing Director, Mr. Lalit Dua, who brings over 31 years of experience in equity investing, M&A, private equity, and structured finance. Under his leadership, the company has emerged as a trusted institutional anchor with deep research capabilities and a long-term outlook.

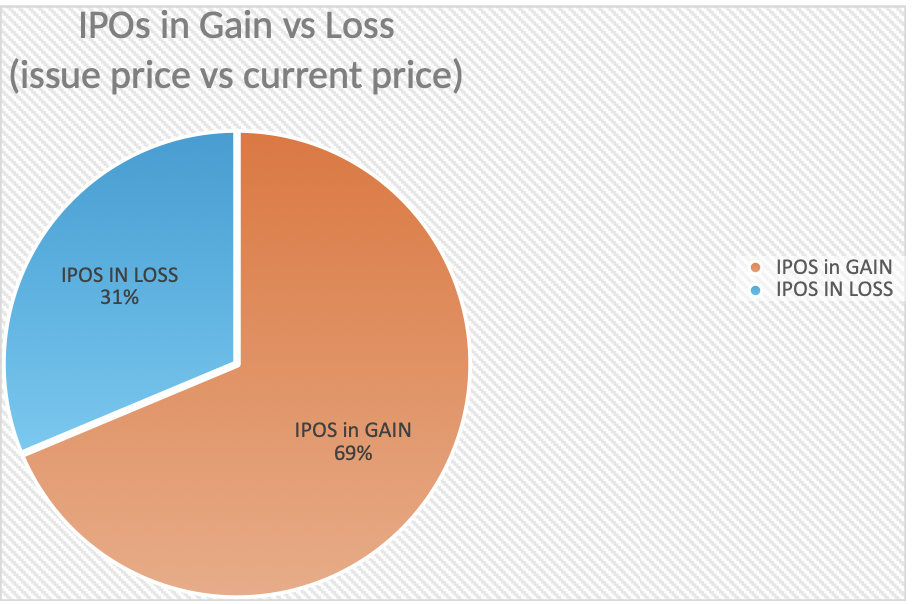

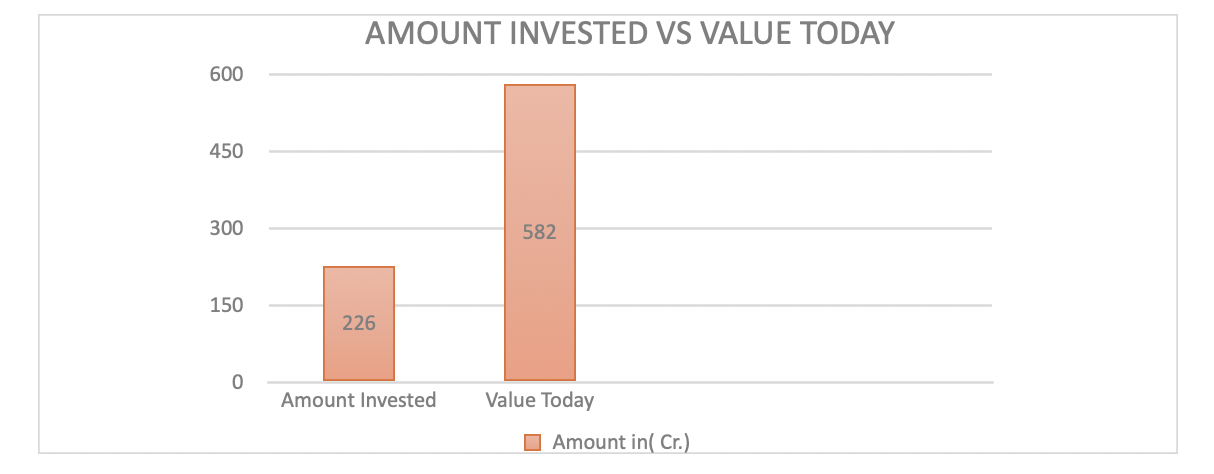

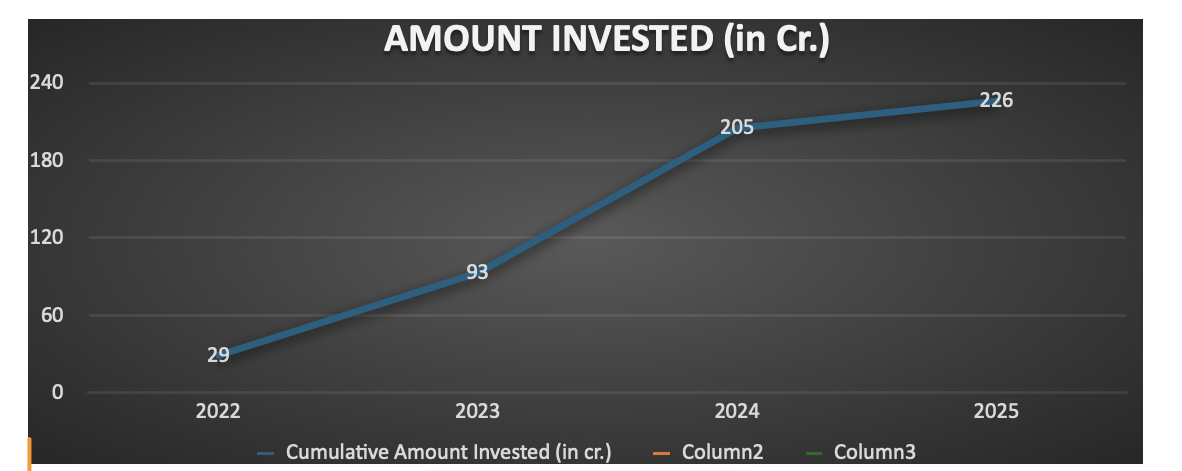

Visualizing RGSPL’s Anchor Investment Journey

To better understand the scale and impact of RGSPL’s contributions to the SME capital market, the following charts present a visual summary of its anchor investment trajectory. The bar chart captures the year-wise quantum of capital deployed by RGSPL across SME IPOs, reflecting both consistency and strategic scaling of exposure. Meanwhile, the pie chart illustrates the distribution of investments across 100 SME IPOs, signifying RGSPL’s pioneering role as India’s most active QIB in this space. These visuals reaffirm RGSPL’s role not just in enabling individual company listings, but in institutionalizing confidence and depth in the broader SME investment landscape.

Diversification Across Merchant Bankers and Sectors

RGSPL has partnered with a wide array of merchant bankers and invested across diverse high-potential sectors, reflecting a balanced and thematic investment strategy.

Top Merchant Bankers backed by RGSPL:

|

Sr. No. |

Merchant Banker |

Number of IPOs in which RGSPL invested |

|---|---|---|

|

1. |

Hem Securities Ltd. |

29 |

|

2. |

GYR Capital Advisors Pvt. Ltd. |

11 |

|

3. |

Beeline Capital Advisors Pvt. Ltd. |

8 |

|

4. |

Share India Capital Services Pvt. Ltd. |

8 |

|

5. |

Narnolia Financial Services Ltd. |

6 |

|

6. |

Choice Capital Advisors Pvt. Ltd. |

4 |

|

7. |

Corporate Capital Ventures Pvt. Ltd. |

4 |

|

8. |

Unistone Capital Pvt. Ltd. |

4 |

|

9. |

Sarthi Capital Advisors Pvt. Ltd. |

3 |

|

10. |

Smart Horizon Capital Advisors Pvt. Ltd. |

4 |

Top Sectors in which RGSPL has invested:

|

Sr. No. |

Sector |

Number of IPOs in which RGSPL invested |

|---|---|---|

|

1. |

Logistics |

7 |

|

2. |

Engineering |

5 |

|

3. |

Infrastructure |

4 |

|

4. |

Electrical Equipment |

4 |

|

5. |

Film and Animation- VFX |

4 |

|

6. |

Healthcare |

4 |

|

7. |

Advertising and Media |

4 |

|

8. |

Information Technology – Data Solutions |

3 |

|

9. |

Steel |

3 |

|

10. |

Education – Edtech |

2 |

Shaping the Future of SME Investing

Rajasthan Global Securities’ century of anchor investments reflects strategic foresight, deep research orientation, and long-term capital commitment. By filling the institutional void when the SME IPO space was still maturing, RGSPL did not just deliver impressive returns—it reshaped the very contours of SME investing in India.

At https://www.ipoplatform.com/ , we proudly recognize this achievement and extend our heartiest congratulations to the entire team at Rajasthan Global Securities Pvt. Ltd. for their unwavering commitment to nurturing India’s entrepreneurial ecosystem.

Their milestone reinforces a vital truth — that visionary institutional capital, when deployed early and intelligently, can become a catalyst for national transformation, supporting entrepreneurs, employment, innovation, and inclusive prosperity.

Credits

- Data compiled from (https://www.ipoplatform.com/anchor-investors )

- Financials sourced from (https://connect.acuite.in/fcompany-details/RAJASTHAN_GLOBAL_SECURITIES_PRIVATE_LIMITED/10th_Feb_25)

- Acknowledgment to Mr. Ajay Thakur’s book: "Vision to Victory – Unleashing India’s SME Platform".

0 Comments