Upcoming IPO 2025 - Meaning, Significance and Outlook for FY26

The Upcoming IPO 2025 landscape is diverse, with significant interest in sectors like telecommunications and digital services (like Reliance Jio), consumer electronics (like boat IPO) among others. The financial year 2025-26 may see an upward trajectory in India’s IPO market. Ather Energy catering to electric scooter segment was the first Mainboard IPO for FY25-26.

What is Upcoming IPO?

An Upcoming IPO refers to a company that is in the process of launching its Initial Public Offering (IPO) but has not yet been listed on a stock exchange. Upcoming IPO can be either a Mainboard IPO or SME IPO.

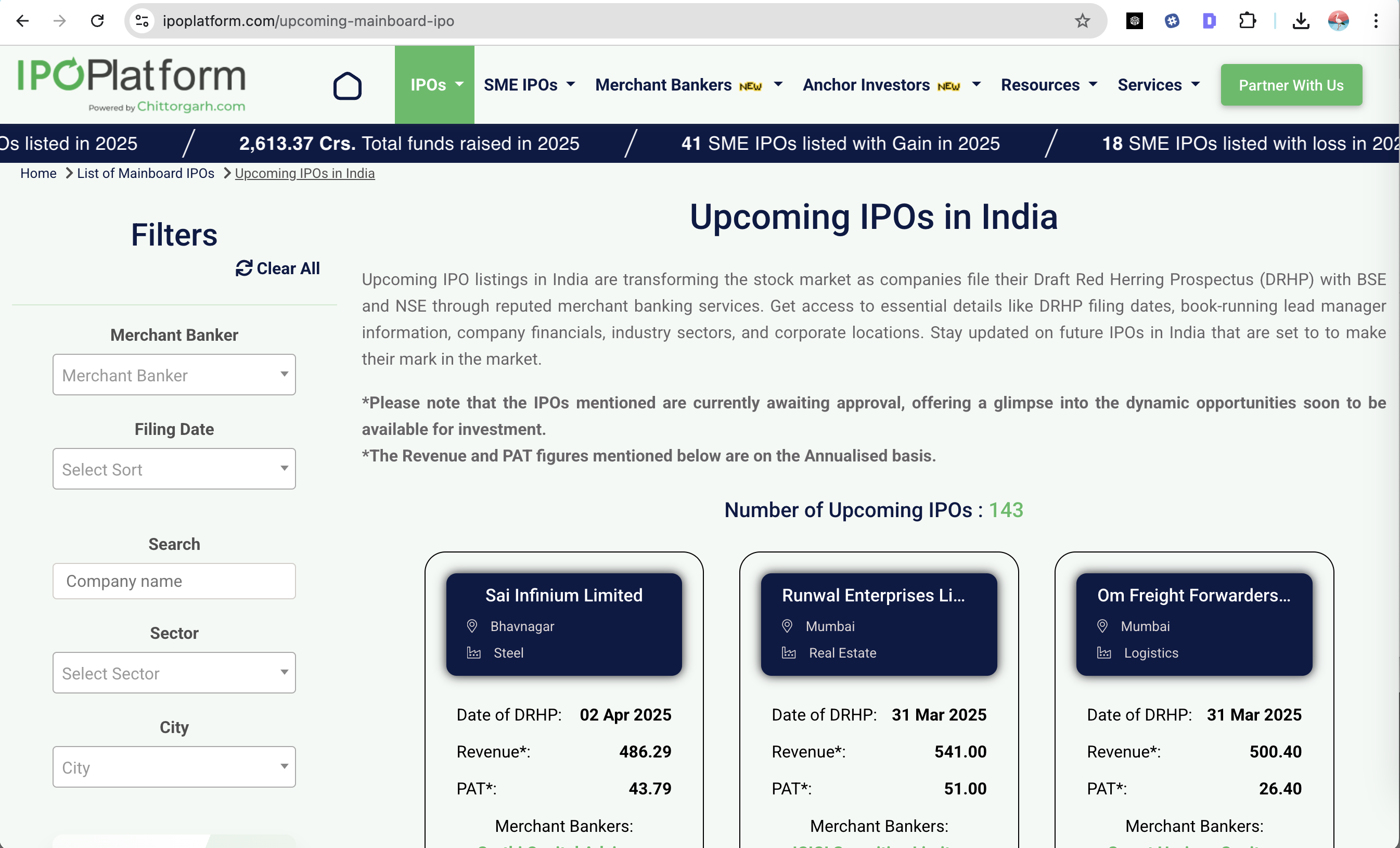

Upcoming IPO refers to the stage where accompany has filed its DRHP with SEBI or relevant stock exchange (NSE Emerge or BSE SME) and is awaiting approval on the same. The DRHP of upcoming IPO is available to the public unless it is a confidential IPO filing. Confidential IPO can be filed on Mainboard only. These companies go through multiple stages before their shares become available for public trading.

Upcoming IPOs provide investors with fresh opportunities to invest in growing businesses, from small and medium enterprises (SMEs) to well-established companies making their public debut.

Upcoming list of IPO and listed Mainboard and SME IPO is available on ipoplatform.com and details relating to business, IPO company financials and IPO valuations can also be seen.

Fund Raise through primary markets

Raising funds through primary markets involves a process to enable companies to raise capital by issuing new securities directly to investors for the first time in the capital markets. This is a crucial way for businesses to finance funds for growth and expansion.

Common methods to raise funds in primary markets are

- Initial Public offer (IPO) through Mainboard or SME listing

- Follow-on Public Offering (FPO)

- Private Placement

- Rights Issue

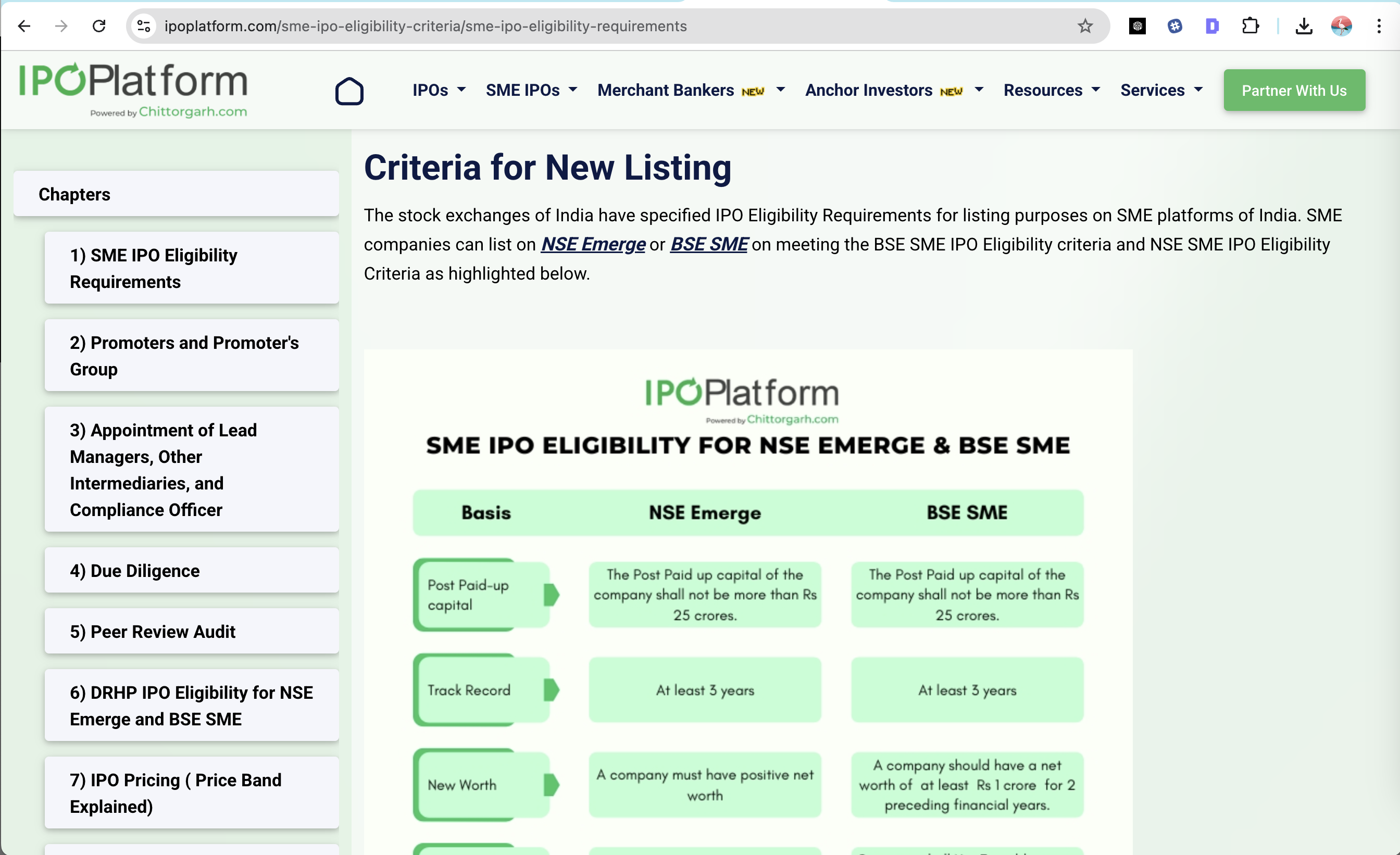

IPO Eligibility Requirements for Mainboard and SME IPO

- Mainboard IPO – Primary listing platform for large cap and already established companies. Mainboard Listings happen on both NSE and BSE.

- SME IPO – Small and Medium Enterprises (SMEs) that meet specific IPO eligibility criteria and list on SME platforms like NSE SME (NSE Emerge) or BSE SME stock exchanges of India.

Before a company goes public, it must meet IPO eligibility criteria and follow the IPO process, which involves approvals, documentation, and regulatory compliance.

Stages of an Upcoming IPO (As per SEBI Regulations)

The Initial Public Offering (IPO) process is governed by the Securities and Exchange Board of India (SEBI) Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2018. Every company planning to raise capital through IPO must comply with these guidelines, ensuring transparency and investor protection. The IPO process consists of several key stages, from regulatory approvals to public listing.

1. Eligibility & Pre IPO Preparations

Before initiating the IPO process, a company must ensure compliance with the IPO and listing requirements set by SEBI and relevant stock exchanges for listing (NSE, BSE, NSE SME, BSE SME). Some key requirements include:

- Financial Track Record: Companies must meet the minimum net tangible assets, net worth, and profitability requirements as per SEBI guidelines. An entity which is not a company has to first convert itself into a private or a public limited company. Check conversion Process

- Corporate Governance Compliance: The company must follow prescribed corporate governance norms, including board structure, independent directors, and financial disclosures.

- Appointment of Merchant Bankers & IPO Advisors: The company must appoint SEBI-registered Merchant Bankers (Lead Managers), legal advisors, and auditors to guide the IPO process.

For details eligibility you can refer to

For details of Merchant bankers, IPO Advisors you can refer to link

For Details of IPO Process you can refer to

2. Filing of DRHP (Draft Red Herring Prospectus)

DRHP is a preliminary document to be filed with SEBI in case of Mainboard IPO and relevant SME Exchange in case of SME IPO. The draft offer document is generally refereed to IPO application by company for purposes of listing. In consultation with the Book running lead manager and assistance with IPO Advisors, the Issuer company prepares DRHP as per the SEBI ICDR Regulations (2018). The Issuer shall file it with SEBI or recognized Stock Exchanges with the prescribed fees as specified by the SEBI.

The DRHP so filed is made public by publishing it on websites of the Issuer company, SEBI in case of Mainboard IPO and in case of SME IPO on NSE Emerge or BSE SME. However, in cases of confidential DRHP filing (Pre filed DRHP), it is not made public.

Some Popular and upcoming IPO in 2025 include boAt IPO, Physicawallah IPO, Credila IPO, Tata Capital IPO which have chosen the confidential IPO filing route for listing.

Following are some key disclosures which form part of DRHP:

- Business Overview & Financials: Details of the company’s operations, revenue model, and financial performance. Business strengths and challenges are also shown here.

- IPO Structure: It includes details like the number of shares to be issued, Offer for Sale (OFS) vs. Fresh Issue. Basis of Issue price, shareholding patterns of promoter and promoter group, Financial Key performance indicators and restated financial statements for last three years are also required to be published in the DRHP.

- Risk Factors: Disclosure of internal and external risks affecting the company and many more.

- Certificates of financial and legal due diligence

However, it is to be noted certain information like the price band for the Issue, Total Issue size and other information regarding IPO valuation which is not finalized at the time of DRHP is left blank and later updated in the Red Herring Prospectus (after approval of DRHP).

Review by SEBI or Recognized Stock Exchanges and their observations

- SEBI conducts a detailed review of the DRHP and may seek clarifications or modifications.

- Time taken for approval of Draft Offer Document- In case of Mainboard IPO, DRHP approval from SEBI may take 4-5 months. In case of SME IPO, stock exchanges may take 2-3 months for approval. The time period for approval may be longer depending on the complexities or other factors regarding the Issuer company.

- The Issuer company shall receive clarifications and observation from the SEBI or recognized Stock Exchanges on the filed DRHP. The company in consultation with Lead Manager is required to give reply to SEBI’s observations and make necessary changes asked by SEBI to make before proceeding further in IPO Process.

3. Filing of UDRHP (Updated Draft Red Herring Prospectus)

The Issuer company is required to make modifications as required by SEBI or Stock Exchange in the specified time. Updated DRHP (UDRHP) is filed after incorporating all the changes as required by the regulatory authority.

4. Filing of RHP (Red Herring Prospectus) and IPO Announcement

- After receiving Approval, the Issuer company is required to file the RHP on SEBI or Recognized Stock Exchanges.

- RHP contains following additional details regarding the Issue:

- Price band for the IPO (not compulsory though)

- IPO open and close dates

- Issue size and Allotment structure of the IPO

5. Opening of IPO Subscription for the Investors

- Investors who are willing to buy the shares they can apply for the IPO from the ASBA (Application Supported by Blocked Amount) mechanism via banks, stockbrokers, and UPI-based applications.

- The subscription typically opens for 3 to 5 days and maximum 10 days

- Investor can apply under different categories:

- Retail Investors

- Qualified Institutional Buyers

- Non Institutional Buyers

- Anchor Investors

Understand IPO Subscription and how it works?

6. IPO Allotment Process

- After the closing of subscription period the Issuer company will finalize the allotment (Basis of Allotment) of the share to the respective allottees.

- Investor can check their allotment status on the website of Registrar to the IPO (RTA).

- If an IPO is oversubscribed then the allotment is done on Pro rata basis (Proportionate basis) or on lottery basis.

7. Listing & Trading on Stock Exchange

- The shares would be credited to the investors Demat account on completion of Allotment of shares.

- Listing of shares on listing date on the relevant stock exchange. The shares are traded in the secondary market

IPO Report of January 2025 , IPO Report for February 2025 , IPO Report for March 2025 , IPO Report for April 2025

Conclusion

Raising funds through the primary markets is a structured and regulated approach that enables companies to access capital directly from investors by issuing new securities. Whether it’s a large corporation listing via a Mainboard IPO, or a growing company opting for an SME IPO, the primary market offers diverse opportunities tailored to different business scales and needs.

The IPO process, governed by SEBI under ICDR Regulations, ensures transparency, investor protection, and market integrity. From pre-IPO preparations, DRHP filing, and regulatory reviews, to public subscription, allotment, and listing, each stage is crucial in building investor confidence and unlocking growth potential for the issuer.

For investors, upcoming IPOs present fresh investment opportunities in promising companies across sectors. Platforms like ipoplatform.com provide access to real-time data on IPO listings, company financials, and valuations—empowering informed decision-making.

In an evolving financial landscape, primary markets not only serve as a bridge between capital seekers and providers but also contribute to the broader economic development by facilitating innovation, job creation, and wealth generation.

0 Comments