Summary of the Offer Document as the name suggests, is a brief summary of the entire DRHP. It is prepared in a very concise form and the investors get a snapshot of the company's business, financials, and the offer structure without going through the entire document. It highlights the most important points about the IPO (Initial Public Offer) to assist in making informed investment decisions.

|

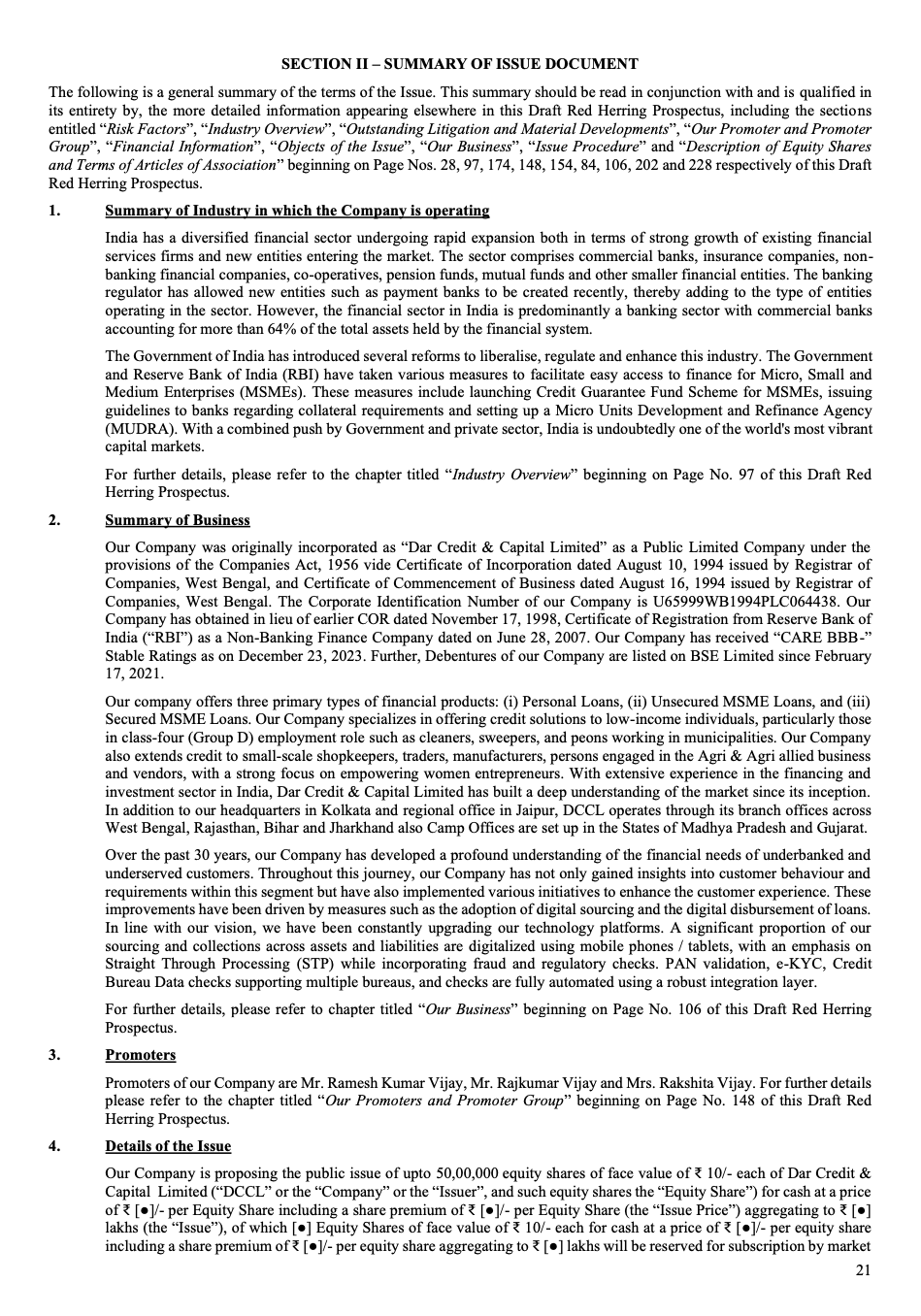

Section |

Details |

|---|---|

|

Overview of Business |

Brief introduction about Business of the Issuer company |

|

Overview of the Industry |

Brief details about the Industry in which Issuer company operates |

|

Promoters |

Details of promoters |

|

Details of the Issue |

All the details regarding Fresh issue, offer for sale, total issue size, etc. |

|

Objectives of the Issue |

Details regarding for what company is raising the Funds |

|

Pre Issue and Post Issue shareholding of Promoters and Promoters group |

Details about the shareholding of promoters and promoter group |

|

Summary of Financial statement |

Details including Key financial figures from the past few years (like revenue, profit, net worth). |

|

Auditor Qualifications |

Details regarding any qualifications given by the auditor to the Issuer company |

|

Summary of Outstanding Litigations |

Details regarding the outstanding litigations of the Issuer |

|

Risk Factors |

Summary of Risk factors |

|

Summary of Contingent Liabilities |

Details rearing the contingent liabilities of the Issuer |

|

Related Party Transactions |

Summary of related party transactions of the Issuer |

|

Details of Financing Arrangements |

Details of Financing arrangements by Promoters, members of promoter group, directors of the Issuer, and their relatives |

|

Weighted Average Price |

Details of Weighted Average Price at which Equity shares are acquired by the Promoters |

|

Average cost of Acquisition |

Details regarding the Average cost of Acquisition at which Equity shares are acquired by the Promoters |

|

Pre IPO Placement |

Details of Pre IPO Placement of the Issuer company (If acquired) |

|

Equity shares Issued on considerations other than cash |

Issuer is required to mention about the shares which are issued on considerations other than cash |

|

Split or Consolidation of Equity shares |

Details regarding split or consolidation of the equity share by the Issuer |

|

Exemption from Complying with any provisions of Securities Laws granted by SEBI |

Issuer is required to mention the details of any exemption which is acquired by them (If any) |

IPO advisors or SME IPO Consultants play a crucial role in guiding the company through the IPO process. They assist with structuring the offering, preparing necessary documentation, IPO pricing with fair valuations, ensuring regulatory compliance, due diligence activity, and helping market the IPO to potential investors. Their expertise ensures a smooth and successful public listing.

IPO platform in India provides information on upcoming IPOs on NSE Emerge and BSE SME and list of merchant bankers and anchor investors. Role of IPO advisor is important in the success of the listings.

IPO Advisors like IPOPlatform.com assist with valuation, documentation, regulatory approvals, merchant banker selection, and investor outreach, ensuring smooth listing and successful fundraising. Their expertise helps companies navigate SEBI compliance, market positioning, and post-listing strategies.

Pre IPO-Issue also has to comply with SEBI ICDR regulations.

A pre-IPO company might get eventually listed on NSE Emerge, BSE SME or mainboard platform of the stock exchanges by fulfilling the NSE/BSE eligibility criteria. Best Merchant Bankers in India have the role and responsibility for launching IPO.

For further details refer this link https://www.ipoplatform.com/blogs/what-is-pre-ipo-investment-and-role-of-ipo-advisors/142

DRHP is a preliminary document whereas RHP is a final version which contains all disclosures and comments as addressed at the time of review of DRHP.

RHP is typically filed 3-5 days before the IPO opens.

0 Comments